How To Claim Tax Back For Students: A Guide To Getting Your Money Back

Are you a student drowning in textbooks, late-night study sessions, and the ever-present fear of a looming student loan debt? Well, buckle up, because I’m about to share a secret that could help you reclaim some of those hard-earned dollars: tax back for students. Yes, you read that right – you might be eligible for a tax refund!

It’s like finding a hidden treasure chest filled with gold, except instead of gold, it’s money the government owes you. Think of it as a little pat on the back for all your academic efforts, a reward for all those late-night coffee-fueled study sessions, and a chance to finally afford that fancy avocado toast (or maybe even a new laptop!).

This guide is your roadmap to navigating the intricate world of student tax refunds. I’ll walk you through the eligibility criteria, different types of expenses you can claim, and the best strategies to maximize your refund. Don’t worry; I’ll keep things simple, sprinkle in some humor, and even share some personal anecdotes to make this journey a bit more relatable. So, grab a comfy chair, pour yourself a cup of joe (or tea, if you’re a sophisticated student), and let’s dive into this exciting world of tax back for students!

Understanding Student Tax Back: Demystifying the Basics

First things first, let’s clear up any confusion about what student tax back actually is. It’s essentially a way for students to claim back some of the money they’ve spent on education-related expenses. The government realizes that pursuing higher education can be a costly affair, and they offer a helping hand in the form of tax credits and deductions.

This is where it gets a bit technical, but bear with me. There are two main ways to claim tax back:

- Tax Credits: Think of these as a direct reduction in the amount of tax you owe. This means you get a dollar-for-dollar reduction, rather than just a percentage.

- Tax Deductions: Tax deductions are a bit more indirect. They lower your taxable income, which subsequently reduces the amount of tax you owe.

The specific tax credits and deductions available to students can vary depending on your country of residence and individual circumstances. For example, in the UK, students can claim the Student Loan Interest Deduction, while in the US, there are tax credits for education expenses.

But hold on! Before you start daydreaming about using your refund to buy a brand-new car (or maybe just a really awesome pair of headphones!), there are certain eligibility criteria you need to meet.

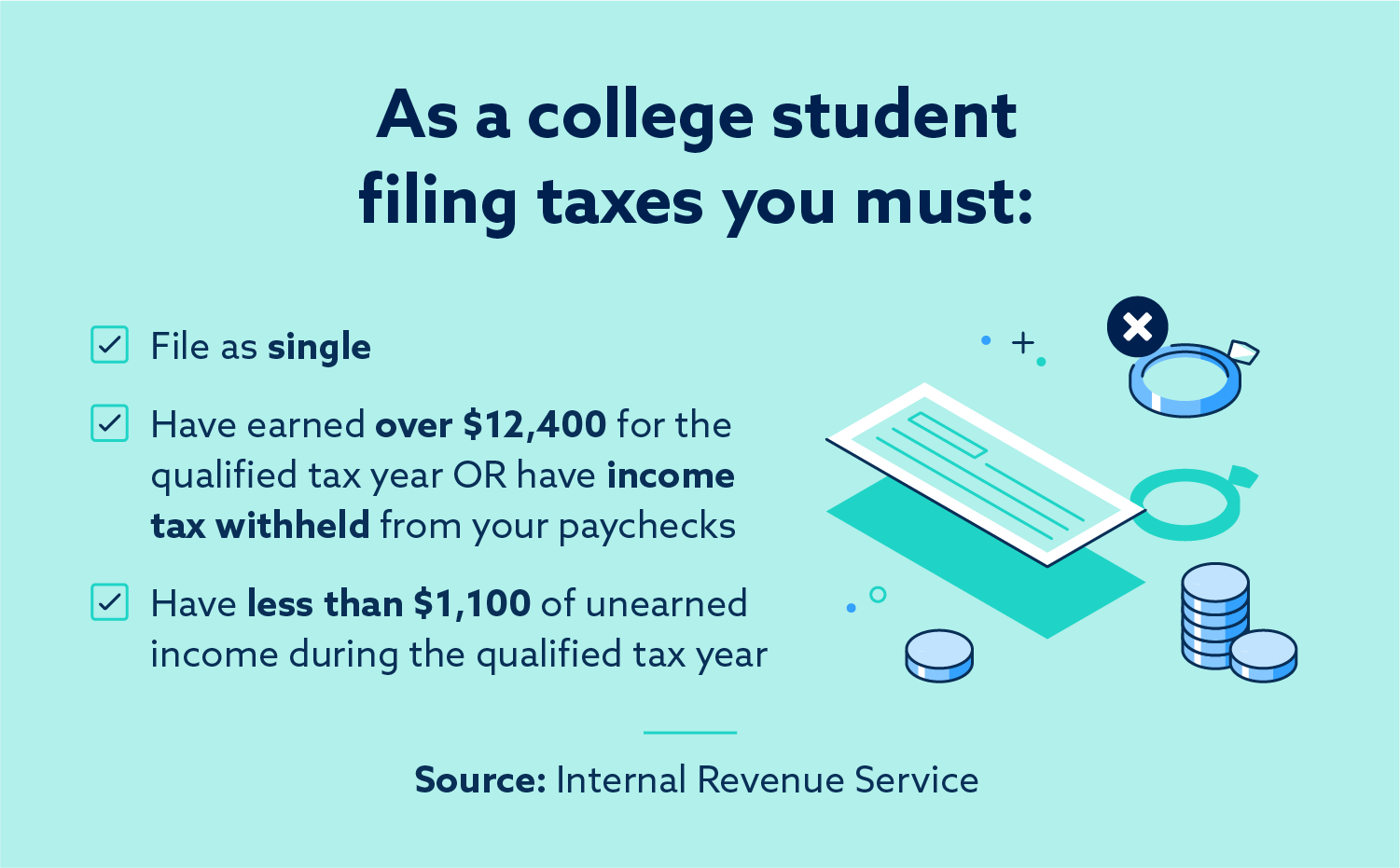

Eligibility Criteria: Making Sure You’re In The Game

So, you’re excited about the possibility of a tax refund. That’s great! But before you start compiling all your receipts and getting your hopes up, let’s take a closer look at the eligibility requirements. You’ll need to satisfy certain conditions to claim tax back as a student.

Here are some common eligibility criteria:

- Status as a student: You need to be enrolled in a qualifying educational program. This could be a college, university, vocational school, or even online courses.

- Age limitations: Some countries have age limits for claiming certain tax benefits.

- Residency status: You might need to be a resident of the country where you’re claiming the tax benefit.

- Income restrictions: Certain tax benefits may have income limitations, so your earnings might need to be below a specific threshold.

It’s crucial to check with the tax authorities in your country for the most up-to-date information on eligibility requirements. This information is readily available on their official websites. Don’t be afraid to contact them directly if you have any questions. They’re there to help!

Remember, this is just a general overview. The specific requirements for eligibility can vary depending on your country and the specific tax benefit you’re applying for.

Tax Back For Students: What Expenses Can You Claim?

Now that you know the basics of eligibility, let’s dive into the juicy stuff: what kind of expenses can you actually claim?

Remember that famous saying, “knowledge is power”? Well, in this case, it’s also money. The more you know about your eligible expenses, the more tax back you could potentially claim.

Here’s a breakdown of some common expenses that students can claim:

- Tuition fees: This is usually the big one! You can often claim back a portion of your tuition fees, whether you’re paying them directly or through student loans.

- Course materials: Don’t forget those hefty textbooks, workbooks, and software licenses! You can often claim these expenses as well.

- Accommodation costs: If you’re living away from home for your studies, you might be eligible to claim some of your rent, utilities, and other associated costs.

- Travel expenses: Are you commuting to school or attending conferences? You might be able to claim some of your transport costs.

- Other study-related expenses: This can include things like computer equipment, stationery, childcare, and even internet access.

It’s important to note that the specific expenses you can claim and the amount you can claim back will vary depending on the tax rules in your country. Some expenses might have specific limitations or thresholds that you need to meet.

Pro Tip: Keep all your receipts and invoices! They’ll be your best friends when it comes to claiming tax back. You’ll need them as proof of your expenses.

Maximizing Your Tax Back: Strategic Tips and Tricks

Now that you have a good understanding of the basics, it’s time to level up your game and learn some strategies to maximize your tax back. Think of this as a student’s guide to financial wizardry!

- Plan Ahead: Don’t wait until the last minute to start thinking about your taxes. Start gathering your receipts and invoices early. This will help you stay organized and ensure you don’t miss any important details.

- Know Your Tax Code: Take the time to understand the tax rules and regulations in your country. The more familiar you are with the system, the better equipped you’ll be to navigate the process.

- Seek Professional Advice: If you’re feeling overwhelmed or unsure about certain aspects of the process, consider seeking help from a qualified tax advisor or accountant. They can provide tailored guidance and ensure you’re making the most of your tax benefits.

- Explore Alternative Options: Don’t limit yourself to the standard tax back options. There might be other financial assistance programs or schemes available, like bursaries, grants, or scholarships.

- Stay Updated: Tax laws and regulations are constantly evolving. Stay informed about any changes that could affect your eligibility or the amount of tax back you can claim.

Personal Anecdote: I remember back in my student days, I was convinced I didn’t have any expenses worth claiming. I thought my tuition fees were the only thing that mattered. It was only when I talked to a tax advisor that I realized I could claim back a significant amount on my books, accommodation, and even my monthly travel pass. It was like a little Christmas miracle!

Navigating the Tax Back Process: A Step-by-Step Guide

So, you’ve decided to take the plunge and claim your tax back. That’s fantastic! But where do you start? Here’s a step-by-step guide to make the process as smooth as possible:

- Gather Your Information: Collect all the necessary documentation, including your student ID, proof of enrollment, receipts, and invoices.

- Choose Your Filing Method: Determine how you want to file your tax return. This could be online, through the mail, or through a tax advisor.

- Complete the Relevant Forms: Fill out the appropriate tax forms for your country, providing all the required information and supporting documentation.

- Submit Your Return: File your tax return within the designated deadline. Missing the deadline could result in penalties.

- Review Your Refund: Once your tax return is processed, you should receive a notification regarding your refund amount.

Pro Tip: Double-check all the information you provide on your tax return. Make sure your contact details are correct and that you’ve signed the form where necessary.

The Tax Back Process: Dealing with Common Challenges

Let’s face it, taxes can be a bit daunting, especially when you’re juggling your studies, social life, and part-time jobs. But don’t worry; you’re not alone! Many students encounter roadblocks along the way. Here are some common challenges and tips on how to overcome them:

- Unclear Information: The tax system can be complex and confusing. If you’re unsure about any part of the process, seek clarification from the tax authorities or a qualified advisor.

- Missing Documentation: Remember those receipts and invoices I mentioned earlier? They’re essential! Don’t lose them! If you do, try contacting the relevant organizations to request replacements.

- Time Constraints: The tax filing deadline can seem like it’s creeping up on you. Don’t panic! Plan your time wisely, start gathering your documents early, and consider seeking professional help if needed.

- Technical Difficulties: Sometimes, you might encounter technical issues with the online filing system. If that happens, try different browsers, update your software, or contact the tax authority for assistance.

Remember, patience and perseverance are key! If you encounter any problems, don’t give up. Reach out for help and remember, everyone makes mistakes.

Beyond Tax Back: Other Ways To Save Money As A Student

While tax back can provide a welcome boost to your student budget, it’s not the only way to save money. Here are a few other strategies to help you stay afloat financially:

- Student Discounts: Take advantage of student discounts! Many companies and organizations offer special deals and promotions for students.

- Part-time Jobs: If you have some free time, consider finding a part-time job. It can help you earn extra cash and gain valuable work experience.

- Budgeting: Create a budget and stick to it. Track your expenses and identify areas where you can cut back.

- Free Resources: Take advantage of free resources like libraries, student centers, and online courses.

Personal Anecdote: I used to live on a shoestring budget during my student days. I’d spend hours scouring the internet for student discounts, bargain-hunting at thrift stores, and cooking meals from scratch to save money. Those experiences taught me the value of frugality and how to make the most of every dollar.

Wrapping It Up: Embrace Your Financial Empowerment

Claiming tax back as a student can be a game-changer! It can help you alleviate some of the financial pressures of higher education and provide you with extra cash to invest in your studies, personal development, or even just a much-needed treat.

Remember, the tax system might seem complicated, but with a little bit of effort, research, and maybe a bit of humor, you can master it! Take the time to understand the rules, plan ahead, and don’t be afraid to seek help when needed.

By taking control of your finances and claiming your rightful tax back, you can truly embrace your financial empowerment! So, go out there, claim your tax back, and conquer the world, one avocado toast at a time!

Don’t forget to check out these resources:

- Internal Revenue Service (IRS): (For US tax information)

- HMRC (Her Majesty’s Revenue and Customs): (For UK tax information)

- Canadian Revenue Agency (CRA): (For Canadian tax information)

Remember, this guide is for informational purposes only. It’s always best to consult with a qualified tax advisor to get personalized advice.

Happy tax season!